How Premium Credit has redefined its premium finance process and customer journey to continue to deliver its market leading insurance premium finance product.

Premium Credit is the leading insurance premium finance provider in the UK and Ireland. The Company’s credit facility offers customers the ability to spread the cost of their insurance over several months. With over two million customers and supporting 2,700 intermediaries and finance brokers, the scale of business means that to Premium Credit, digital enablement is tantamount to the future success of the company. With a number of digital technology projects rolled out over the past few years, Premium Credit is striving to grow penetration of finance and improve the customer experience the company delivers.

Premium Credit has two main lines of business. Products like Fairway Credit and School Fee Plan offer finance to pay for annual memberships and fees. However, the main business comes from its partnerships with insurers and brokers to offer finance to insurance customers. “It’s a very efficient and effective method of providing finance,” says Tom Woolgrove, Chief Executive, Premium Credit Limited.

AS A BOX OUT:

Aliatech:

We've had a great digital transformation journey with Premium Credit, starting with their office move, enabling them to create flexible workstyle, and helping map out where our solutions could be applied to maximise take-up for all their staff. Altiatech meticulously evaluated the best technologies for the needs of Premium Credit and its workforce, ensuring compatibility, efficiency and performance were retained in all our deployments, whilst adhering to their conservative budgets. Our solutions experts delivered above and beyond expectations, which returned excellent value to Premium Credit, with technologies such as:

CleverTouch and Epson Interactive Brightlink projectors to enhance training, creative thinking and collaboration.

Moving into a New Cloud centric arena, focussing on the Microsoft Cloud, hosting their third datacenter in Azure to providing real time analytics with Microsoft SCOM.

Delivering frontline security to a £4 billion business, offering comprehensive threat protection against advanced and evasive targeted attacks, along with real-time, in-line threat intelligence that protects critical data, applications, and infrastructure. All of this without affecting network performance and internal coherence.

We at Altiatech have established a strong, technology focussed partnership with Premium Credit, fulfilling their business needs and continuing to deliver solutions that meet future requirements. Altiatech is confident of achieving the same results for its other customers in the manner we have done for Premium Credit.

The company provides these customers with the opportunity to pay their annual insurance premiums, which are established and arranged through insurance brokers or producers, through monthly payments. Increasing flexibility is key towards the underlying goal of creating ease of access for the customer, efficiency for the intermediary, all the while improving the business.

“There’s an ease of use for people. Whether they come to us for an enquiry or set up an adhoc payment, we support them throughout their agreement to offer them the best service. Premium Credit aims to make the customer payment journey as easy as possible.”

Digitally enabled

Historically, completing insurance premium finance proposals and credit agreements within the insurance broker market would be a 100 percent paper business. Now, more and more companies are undertaking digital customer journeys. Premium Credit is breaking new ground, integrating itself into those broker journeys to enable intermediaries the ability to manage the whole customer journey and process electronically.

Looking at it from the perspective of the end customer, this will allow e-signatures, processing online payments through a mobile or tablet device, and having the ability to access their credit agreement documents electronically.

“Wherever possible, we are making the customer journey self-service or digital. For brokers, it’s about integrating as best we can with their existing systems and tools to make the process seamless,” says Woolgrove.

“The overall goal is to make it easy for customers to interact with us in any way they want, which in today’s world means that most of that interaction is available online and is designed to be as simple and straight forward as possible.”

With technological innovation and an ever-growing increase of power at the customer’s fingertips, it’s difficult to pin down a single moment that kick-started this digital process for Premium Credit. Simon Moran, Chief Sales & Marketing Officer, has been with Premium Credit for 18 years and goes as far as to say that this process is best represented in phases.

Commencing around 10-15 years ago, large scale electronic data interchange between systems laid down the foundation for the next phase of more self-service opportunities for the end customer and for brokers. The current phase for Premium Credit is allowing that to be more and more channel agnostic, with the company’s exchanges and interactions with customers and brokers available across all devices.

“We are increasingly able to support customers to move between channels when interacting with us and that’s the same for our brokers. Access to information and customer journeys via mobile has grown rapidly” says Moran.

“It’s been an ongoing journey as we react to end-user demand and build the technologies to meet that demand, and plan for the next technological advancement.”

Penetrating the finance market

Premium Credit, as the leading premium finance provider, has always invested in creating digital ease of access for customers. This included a previously existing customer portal that allowed customers to conduct basic tasks, but initially, overall flexibility was limited. But through financial investment and a commitment to technological growth from the company’s private equity owners Cinven, Premium Credit has been able to continuously improve its customer experience and grow the penetration of its products to become more efficient as a business.

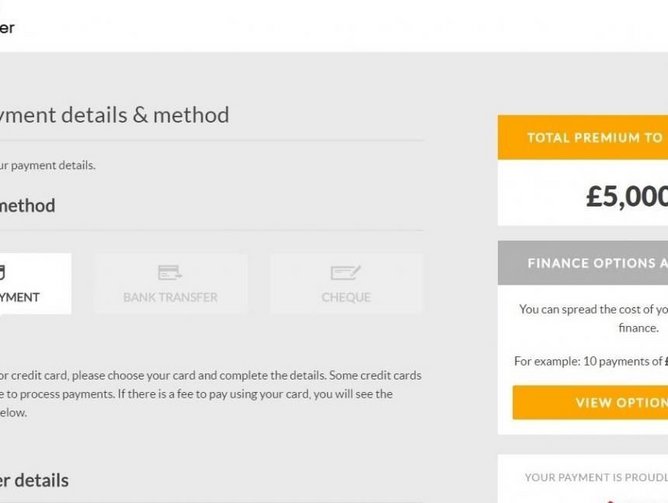

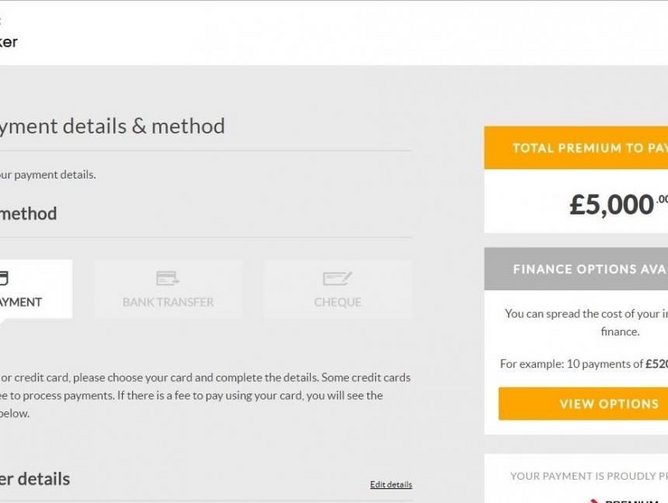

This is where the company’s EPICC solution comes in. EPICC, short for Electronic Payments for Insurance Customers and Clients, is a point of payment platform that integrates into the insurance brokers’ underlying customer journey.

“Our market research with customers and brokers identified an inconsistency in the frequency and quality of premium finance offered. EPICC solves this. At the end of the insurance broker’s journey, where they have established an insurance policy with the customer, we can now insert ourselves into the payment journey and provide payment choices for customers and a consistent offer of premium finance,” says Moran.

Moran describes EPICC as market-leading and a big step change for Premium Credit, as it moves them from being simply a specialist premium finance company, to a full payment services provider. Through the EPICC solution, Premium Credit allows customers to self-select payment options, ensures a consistent offering and compliant journey for brokers and provides analytical data on penetration. When and how did the customer open an email communication? Have they taken action and taken finance? EPICC allows more transparency in terms of where the customers are on their journey with the company.

As a further benefit to the broker, Premium Credit re-skin the journey and all communication to the brokers brand, effectively improving the customer experience overall.

Through a long testing period, Premium Credit has been rolling out EPICC to brokers and customers to learn more about the solution, its capabilities and where it can be improved to better serve the customer. The solution has allowed the company to test different forms of communication, which in turn allows it to see the varying levels of response and penetration of its products in the market.

“The overall feedback has been very positive and customers have found it clear and intuitive,” says Woolgrove.

“They like the flexibility to be able to pay online, the confidence it allows them to have in the journey and the options available to them. They feel informed. It’s a very positive experience for customers and brokers. We believe that by presenting finance digitally alongside other forms of payments we will increase penetration.”

Like any technology, EPICC is something that will continue to be developed and iterated as customer demands change. Woolgrove sees EPICC as a core platform which the company can build upon. By measuring the way in which customers interact and use the system, Premium Credit can develop the software and assess how it can be incorporated into wider business sectors. Sectors like Fairway Credit’s golf club membership finance, for example, would benefit from the ease and simplicity that it provides to the customer journey, reducing the administration burden.

“Initially it is focused on corporate and commercial customers, but we will extend it to retail customers, and to other business lines such as our Fairway Credit, School Fee Plan and My Commute for Less,” he says.

“We believe it’s a way of increasing how we interact with our intermediaries and our customers. Effectively EPICC is a long term strategic platform that will better enable this.”

Legacy systems, future growth

With a complete restructure of a technological process, challenge is inescapable. For Premium Credit, as with many large businesses, legacy technology infrastructure represents a key challenge.

“It’s about establishing what the change capabilities are for the company. We aren’t early adopters, we are identifying established technologies and tailoring those to our intermediaries and our customers’ needs,” says Woolgrove.

“The key challenge is understanding what people want and need, and delivering against it. It’s not about rolling out the latest “big technology”, but about delivering what customers want.”

Looking to the future, the goal is to continuously improve efficiency and become more digitally enabled as a company. Future investments will include enhancing the customer portal, delivering more self-service tools and applications, and enhancing the analytical insight the company offers.

“We will continue to grow our offering and grow into other segments of business. Looking longer term, our core product system allows multi-language and multi-currency, and we are continuously creating opportunities to expand our business,” Woolgrove says.

“It’s about giving ourselves all of these future opportunities to grow and become a smarter and more efficient business.”