Zurich Insurance: Penetrating the digital insurance market

Zurich Insurance Group has been operating in the Middle East for almost 30 years. As a company that is recognised for its life insurance and long term savings solutions, Zurich Insurance is a market leader across the region. Through Zurich International Life, the company provides savings, investment and protection products to customers and clients across the UAE, Bahrain, Qatarand Hong Kong.

“Our objective is to help customers plan their financial futures. The solutions we provide are aimed at giving people peace of mind,” says Reena Vivek, Chief Operating Officer, Zurich International Life.

Plugging the information gap

Vivek is based in the Dubai branch of Zurich and she admits that the financial industry within the Middle East is still very much a growing industry in its infancy. This presents a series of regional challenges that Vivek and Zurich have both recognised and overcome in the journey to become one of the international leading, award-winning insurance solutions provider.

One such challenge has been the lack of awareness within the market on the importance of insurance.

“This market has a high savings potential with the absence of personal income tax and a high GDP per capita. However, customers in the Middle East need to be educated on the importance of savings and protection,” says Vivek.

The insurance industry in the Middle East is under-penetrated and this presents what Vivek describes as an exciting opportunity for Zurich to invest, not only in educating its customers and distributors but also improving the overall customer experience.

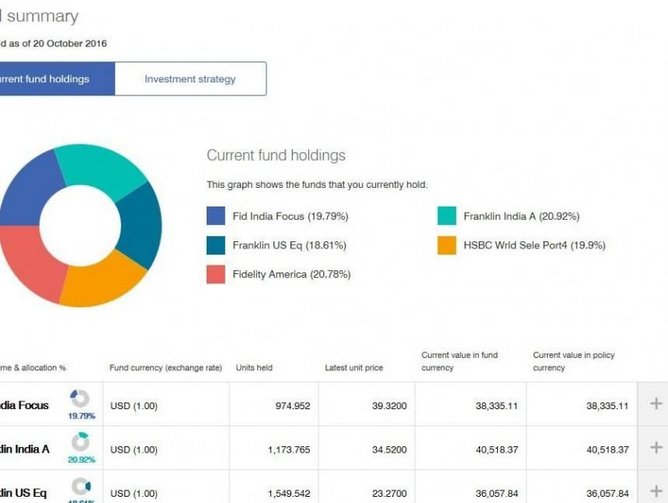

“Insurance products tend to be complex in their nature and we want to make sure people understand what they have purchased and continue to remain invested in those solutions – so one of the things we have done is strengthening our online platform to educate and service more customers,” says Vivek.

Simplicity in service solutions

Part of the way in which Zurich is improving the customer experience is through significant changes in the way the company communicates with both customers and distributors. Due to that complex nature, insurance documentation and communication can be wrapped up in jargon that can be complicated and difficult to understand as a customer.

Communication, Vivek says, is key to making sure that customers understand the products and solutions they have purchased and more importantly, remain committed to these long-term solutions.

“Zurich has enhanced its online customer platform significantly to make sure that it provides information to its customers in a simplified, jargon-free manner,” says Vivek.

The transformation of the customer experience and journey extends to the simplification of the sales process. When a customer purchases life insurance cover over a certain amount, a medical examination must be completed in order to proceed with the insurance process.

This, Vivek believes, creates a readymade excuse for not purchasing life insurance as the process is often lengthy.

“Zurich has therefore launched a service called Nurse Screening, in which a qualified nurse will visit the client at a time and place of their convenience to conduct the medical exam. Around 80 percent of our protection policy applicants go through this process, which is a very customer centric and simplified process,” she says.

Power to the partner

The digital transformation very much starts with the customer. Through a partnership with Each and Other, a Service Design company based in Dublin, Zurich conducts market research to map the customer’s journey with Zurich.

Once this journey is identified, it allows Zurich to prototype and test improvements and customise it to better suit specific market requirements. This process of test and learn ensures that the ultimate solution or process that is delivered is in line with customer and distributor expectations.

To deliver market leading insurance product solutions, Zurich works with a number of key distribution partners in what Vivek describes as an Intermediate Distribution model. This means that Zurich does not directly sell the insurance policies, but the distribution partners do.

“We have terms of business with over 80 brokers and over 12 banks in the region, including exclusive arrangements with HSBC, Citibank and a new agreement with ADCB’s Simply Life,” says Vivek.

This model allows the needs analysis and initial client interaction to be conducted by the distribution partner and once an application is completed, it is handled by Zurich. The company then issues the policies and works closely with the partners moving forward to ensure the on-going service to the client is of a high standard.

Removing barriers

Partner distributors play a key role in the delivery of Zurich’s insurance products and so the distributor’s experience has also been looked at and reassessed. Zurich has created a process in which a financial professional and customer sit together and generate a quotation electronically using Zurich’s Quote and Apply solution on a tablet device. Once the solution is agreed and the electronic application is complete with an e-signature, it is sent through to Zurich for processing, all at the touch of a button.

“The focus has been on removing the barriers which make purchasing insurance solutions difficult and removing the barriers to understanding what has been purchased,” says Vivek. “It’s about keeping the client informed about their policy so they are happy to remain in it.”

A further part of this transformative project has seen Zurich move a number of capabilities to Dubai and creating the Claims Centre of Excellence for Zurich International Life. The claims process is a key part of any insurance company and Vivek believes that transparency is key in both strengthening the relationship with the customer, and also differentiating Zurich from other insurance companies.

“We are constantly striving to improve the speed with which our claims are paid out and also increasing the number of claims we pay,” says Vivek.

In moving such market facing departments closer to the core market of Zurich International Life, Zurich has increased its employee base in Dubai by over 40 percent in the last 3 years. Vivek says this results in an increased market focus, as the company is fine-tuning what they deliver and its relevance to the customer.

Customer focus

The customer is very much the driving force behind the digitilisation of Zurich Insurance. Through a process of a Net Promoter Score Survey, which looks at whether customers and clients can be considered promoters or detractors of the brand, Zurich identified a need for change and for Vivek, this created a need to look both externally and internally at the company’s processes.

“It made us step back and look at the company through a customer lens. As an insurance company it’s amazing how easily you can fall into the trap of being internally focused, and being very difficult and complex to engage with. Customers want simplicity and transparency,” she adds.

The net promoter survey kick-started the transformation of the company’s digital presence. Customers in the modern market want convenience and with more power at their fingertips, through tablets and smartphones, it is crucial for a business to succeed to deliver on those digital fronts.

Customers also demand transparency, and for an insurance company transparency on its track record on Claims payment is vital. Zurich publishes its data on the number and value of claims paid out on an annual basis, something that Vivek describes as a testament to the fact that the company comes through when clients need it the most. Zurich is the only international insurer that publishes its claims statistics that are specific to the Middle East.

Enabling innovation

Zurich has invested over $25million enhancing the company’s digital capabilities to respond to the market demands. A key advantage for Vivek has been the involvement of the wider Zurich group which has allowed a larger focus on R&D across international markets and relaying it back to the Middle East.

Naturally this raises questions that need answering as to whether there is market relevance or if the market is ready to adopt particular technological innovations.

“We are conscious about making sure that any technology we invest in is relevant to the market, it’s either adding value to the distributor or to the customer. We don’t want to adopt too fast and get ahead of the market,” says Vivek.

Vivek identifies that innovation is less invested in across the Middle Eastern insurance industry. It is the banks that can be seen as the lead indicators of what insurance companies should be looking to invest in in the future. “There’s real innovation here in the banking industry that could be globally trend setting,” she says.

Some of those trends include the introduction of voice recognition for passwords, creating a more secure customer experience. Innovation is also happening across the payment space with cashless payments.

The UAE has recently introduced Direct Debits and while direct debit is common in the much more mature European markets for example, it is still a new concept in the financial market in the Middle East.

“It’s a real positive here in the Middle East to have Direct Debits and we are working with our bank partners to try and introduce that as a more secure method of payment for our customers,” says Vivek.

Award winning

The digital transformation has been ongoing for the last three years and Zurich has already begun to reap the rewards, not only improving the overall net promotor score but also taking home multiple awards at the International Life Awards, International Fund and Products Awards and the MENA IR Awards 2016.

“It is validation that we are on the right track, doing the right thing and hitting the right customer pain points,” concludes Vivek.