Mastercard: delivering convenience and peace of mind every time you pay

For decades one of the world’s most established financial operators, it is arguably the past 10 years which has seen Mastercard’s most prolific innovation and transformation drive, spearheaded by a burgeoning talent pool and demand for digital.

Innovation has always been part of the company’s culture since it was founded. The company celebrated its 50th anniversary in November 2016.

Robert Reeg, now President of Global Technology and Operations for Mastercard, has been a part of the company’s journey for 21 years and helped bring innovation to the forefront of the minds of the entire 10,000-strong workforce.

“Seven or eight years ago we asked all our employees to look at and rank us on a number of different attributes. At the time, innovation came in toward the bottom of that list,” he says. “This has been a huge focus point since, getting across that message that innovation is part of everybody’s job, not just the tech guys or one part of the group. We all have to think how we can do things better.

“I had no idea we would grow as fast as we have. The whole secular shift from hard currency to digital access to money has changed the way people think about how they buy things. The safety and convenience of electronic versus carrying around cash or writing cheques is now clear and Mastercard has played a massive part in that shift.”

The dual benefits of digital

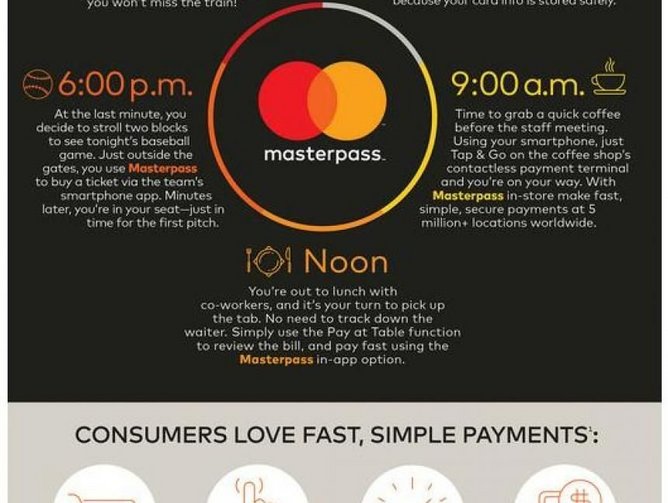

Two recent projects underline the double-edged benefits of payments digitisation Reeg mentions. The first is Masterpass, an omni-channel digital wallet service that has been rolled out across the USA and is available to use at millions of retail locations in dozens of countries around the world.

Masterpass is a result of one of MasterCard’s tried and tested approaches to innovation and recruitment of talent – investments in disruptive technology companies. Indian digital wallet expert C-SAM was recently acquired by Mastercard and its 350 mobile software engineers have been influential in deploying Masterpass.

“If you try to grow mobile technology on your own it takes a long time, so this acquisition allowed us to enter the market very quickly,” Reeg adds. “This is the next phase in how digital money is going to be managed – people need ease and safety in making payments and this is going to be key.”

Indeed, security is the second major advantage of digital over traditional payments. A key area of focus for Mastercard has been development of biometric verification, the company now piloting its Identity Check system or what the media has been calling ‘selfie pay’. For transactions up to a certain value, consumers can take a picture of themselves which is then verified when they go to make those purchases. This builds on the work already carried out on fingerprint technology, which saw the launch of the world’s first contactless payment card featuring an integrated fingerprint sensor in 2014.

“Biometrics is the next frontier,” Reeg says. “The issue you have now is people hate trying to remember 20 unique passwords, which actually aren’t that secure, so there is a double benefit here of convenience and security at the same time. I believe that in the next five years biometrics will become the primary method of verification.”

Expanding Mastercard’s reach

The Masterpass launch and acquisition of C-SAM is one of many examples of Mastercard acquisitions bearing fruit in terms of yielding expertise. Although a lot of development is carried out in-house, the company has made that house significantly larger via a series of acquisitions during the past few years.

Reeg continues: “One of the most significant was the acquisition of Orbiscom in 2008, headquartered in Dublin. They had a product we really liked that we have re-named ‘In Control’, that helps people manage where and who uses their digital money.

“Even more significant than the product itself, however, has been the people we acquired, and they have been key in changing the landscape of innovation at Mastercard. Their CEO Garry Lyons became our Chief Innovation Officer.”

Another acquisition, this time in the marketing sphere, was the purchase of APT in Western Virginia in 2015. Its Test and Learn product helps companies tailor investments and maximise bottom-line impact by harnessing analytics to design, measure and calibrate marketing, merchandising, operations and capital initiatives.

Start Path

Acquisition is not the only route Mastercard has taken with partner companies, however. The Start Path programme provides initial support in start-up technology companies, whether it be capital, mentorship or office space to help them get off the ground.

As part of the programme, companies interested in working with Mastercard apply for the different cohorts. Mastercard selects companies from those applicants and partners with them to help them scale up operations. By granting start-ups access to its global ecosystem and customer bases, it is also widening its own knowledge base in the process, as well as offering another way to infuse innovative thinking into the organization.

Features of the initiative include a six-month virtual programme and two immersion weeks in different Mastercard cities, with no commitment required of the start-ups to offer equity in return. Mastercard employees from different disciplines help mentor the companies, as well.

Honing talent

Alongside the shift in consumer behaviour to digital payments has been a shift in Mastercard’s internal approach to technology and innovation, with tremendous emphasis on gearing the company towards younger recruits.

“The largest part of our workforce today is made up of millennials, so it’s key to make sure our workforce is aware of how quickly things are changing in technology, so we are best positioned to take advantage of new opportunities,” Reeg says.

“There’s no way of saying how many members of our team work in innovation, as we are all responsible for it at Mastercard. Maybe 15 years ago you could separate technology or innovation people from others in the business. This blending is just going to keep on happening and we no longer separate technology from business – the traditional R&D team ethos is ebbing away.”

Reeg also points to the role CEO Ajay Banga has played in transforming Mastercard into a business that resonates with millennial, tech-savvy workers. “The motivations are different to when I was joining workforces in the late 1970s,” he adds. “Attracting and retaining great talent from schools and colleges is much more competitive than ever before. We know that by challenging smart people to come in make contributions right away, we offer a different and more compelling experience and a great place not only to start, but grow a career.”The company offers a reverse mentoring initiative, which sees younger employees share their digital knowledge with more senior colleagues, who in return provide mentorship on the wider business and valuable career advice.

“For someone like me, I get coaching on the latest social media tools, and having someone who is straight out of college who has been immersed in technology their entire lives is such a help in this process,” Reeg says. “In return I can help them in terms of advancing their career in the business. It’s a win-win for both parties participating, and helps make Mastercard a stronger company overall with this relationship building.”

Retention and inclusion

While attracting and developing employees is paramount for an innovating organisation such as Mastercard, making sure talented workers stay on at the company in the medium-long term is equally as important.

Extensive paternal and maternal assurances, financial wellness programmes, flexible working hours, incentive schemes and education support are among the benefits on offer to staff. A culture of inclusion, tolerance and diversity is also at the forefront of Mastercard’s approach to the working environment, led by Chief Diversity Officer Donna Johnson.

“We know that by bringing together employees of diverse background who combine their thoughts, experiences and background, we can advance innovation and offer more meaningful products and solutions to our customers and cardholders. It’s that simple – making sure you empower employees to share their ideas and as a leader, you listen. Our people truly are an amazing asset as we think about what’s next in payments.”

“I’ve been here 21 years – I never thought I’d work anywhere 21 years,” Reeg adds. “It’s one of those places where you wake up in the morning and want to come into work. We work with great people in an exciting area where the business is always changing.”

Mastercard is also active in encouraging more women into pursuing careers in technology. “The issue in most developed countries is that there are fewer and fewer women going into hard sciences,” Reeg says. “We have a programme called Girls4Tech where we start in middle school trying to help influence girls and show the types of careers that they can have in technology. Many young women come in not sure if a career in tech is for them – but once they go through the program, they see many more options in front of them. It’s both refreshing and encouraging to see!””

Girls4Tech has just completed research which identifies the top two reasons for girls aged 12-19 not wanting to pursue a career in STEM (Science, technology, engineering and maths) subjects – difficulty to study and a lack of interest in the subject matter. This is where Mastercard’s employees come in. Launched two years ago, more than 5,000 girls and 1,000 members of staff have taken part in the programme across 11 countries. Mastercard has also penned agreements with Be Better and UN Women to take Girls4Tech to China and Singapore respectively, with the goal of reaching another 54,500 young women.

Equaliser

Mastercard’s inclusion culture ambitions stretch far beyond its own recruitment and outreach programmes. The ultimate endgame is to use digital payments technology as an equaliser across the world, bringing vital financial services to unbanked populations.

By continuing to innovate and work with disruptive, fast-moving technology companies, Reeg believes Mastercard and its workforce have a crucial role to play in the future.

He concludes: “We have the opportunity to help shape the world and bring more people into the formal economy.. There are two billion un- or underbanked people in the world - and we want them to have the same access that anybody else has.”

“This is something that we can continue to play a huge role in and be proud of leading. Technology is a great equaliser and we want to help level that playing field for everyone involved.”