EU businesses favour flexible IT purchasing strategies

With the pandemic having rapidly accelerated the digital transformation of businesses across Europe, new research reveals a significant shift in the purchase and acquisition of technology for companies in 2021.

More than half (54%) of EU businesses will move away from using large capital expenditure to acquire IT assets in 2021, favouring instead more flexible procurement models, research from Finnish technology lifecycle management provider 3Step reveals.

The research, compiled from a survey of 1,000-plus IT decision makers , demonstrates how businesses are increasingly prioritising the ability to replace assets easily when making purchase choices, in order to meet ever-changing circumstances.

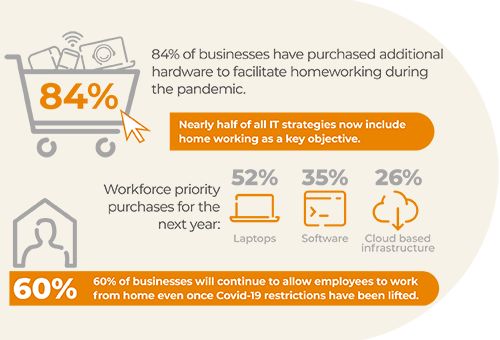

The uncertainties and changes caused by COVID-19, including increased remote working, has demonstrated the need for more agile solutions, with businesses that had previously adopted a more flexible approach to IT acquisition better able to cope with the disruption.

A majority (89%) of companies that loan IT assets were able to make quick IT investments early last year, enabling employees to make the necessary shift to working from home, compared to 75% of businesses who own their IT assets outright.

“For many companies, the cost of shifting to mobile working require significant capital outlay, at a time when businesses are under unprecedented financial pressure,” says Carmen Ene, CEO at 3stepIT. “This traditional cash ownership model places a huge burden on businesses and is a fundamental block to better performance.”

Therefore, as organisations adapt and rest for the year ahead, IT purchasing strategies is likely to be dominated by demand for flexible solutions with mobility remaining an urgent IT priority.

BNP Paribas is one company that’s recently procured a more flexible approach, signing up to a series of sustainable IT solutions across corporate Europe.

“By prioritising access and flexibility, businesses kickstart a process of IT management that lowers the total cost of ownership, accelerates digital transformation, and offers greater flexibility, ultimately ensuring that employees have the right technology in place to drive growth,” adds Ene.

- Cloud is driving IT spending through the roof across EuropeTechnology

- Top 10 leading digital transformation providers in SaudiDigital Strategy

- EY appoints MENA Markets Leader, amid regional renaissanceLeadership & Strategy

- Why we must take a more strategic approach to digital skillsDigital Strategy